tacoma sales tax increase

City of Arlington Retail Sales Tax New Location Codes Benton County Mental Health Tax Benton. The 103 sales tax rate in Tacoma consists of 65 Washington state sales tax and 38 Tacoma tax.

In both 2020 and 2021 sales taxes came back higher than expected.

. Higher sales tax than 98 of Washington localities -07 lower than the maximum sales tax in WA The 103 sales tax rate in Tacoma consists of 65 Washington state sales tax and 38. Some local tax rates increasing Tax rate changes effective July 1 2022. Effective April 1 2019local sales and use tax within the City of Tacoma will increase one-tenth of one percent 001.

It is projected to raise more than 600000 in 2012 and approximately 26 million in 2013. The action increased Tacomas sales tax from 102 percent to 103 percent adding a dime to every 100 purchase not including groceries. 2022 Washington Sales Tax Changes Over the past year there have been 72 local sales tax rate changes in Washington.

This year the City of Tacoma will collect an estimated 62 million from a sales tax increase passed by voters in 2018. Call 253 591-5252 or click below to learn about all available payment options. On April 1 sales tax in.

Will that revenue go toward. 28747 on March 30 2021 a sales tax increase of 110th of 1 percent in support. The 103 sales tax rate in Tacoma consists of 65 Washington state sales tax and 38 Tacoma tax.

The tax will be used for. The tax will be used for cultural access programs. 28747 on March 30 2021 a sales tax increase of 110th of 1 percent in support of affordable.

The tax which will add one penny to a 10 purchase will go into effect on July 1. In Pierce County Tacoma will see a slight rate increase of one-tenth of one percent to 3 percent. The tax will be used for chemical dependency or mental health treatment.

This is the total of state county and city sales tax rates. Tacoma WA Sales Tax Rate Tacoma WA Sales Tax Rate The current total local sales tax rate in Tacoma WA is 10300. Tacoma has had a sales tax rate of 103 percent since July 1 when its one tenth of 1 percent sales tax increase to fund affordable housing projects went into effect.

The minimum combined 2022 sales tax rate for Tacoma Washington is 103. Broken down Tacoma imposes. All Tax License services can be done over the phone andor online.

Sales and use tax within the City of Tacoma will increase one-tenth of one percent 001. This table lists each changed tax jurisdiction the amount of the. The action increases sales tax.

Tacoma City Council on Tuesday voted unanimously to approve a one tenth of 1 percent sales tax increase to fund affordable housing projects. The sales tax increase authorized under Tacoma Creates went into effect April. Make sure you dont end up footing part of your customers bill or delaying your incentive payment by charging the wrong sales tax amount.

With the City Councils passage of Substitute Ordinance No. The December 2020 total local sales tax rate was. What is the sales tax rate in Tacoma Washington.

Pierce County saw sales tax revenues increase from 1286 million in 2019 to 1414 million in 2021. The City of Tacoma will establish a Transportation Benefit District TBD.

Washington Sales Tax Rates By City County 2022

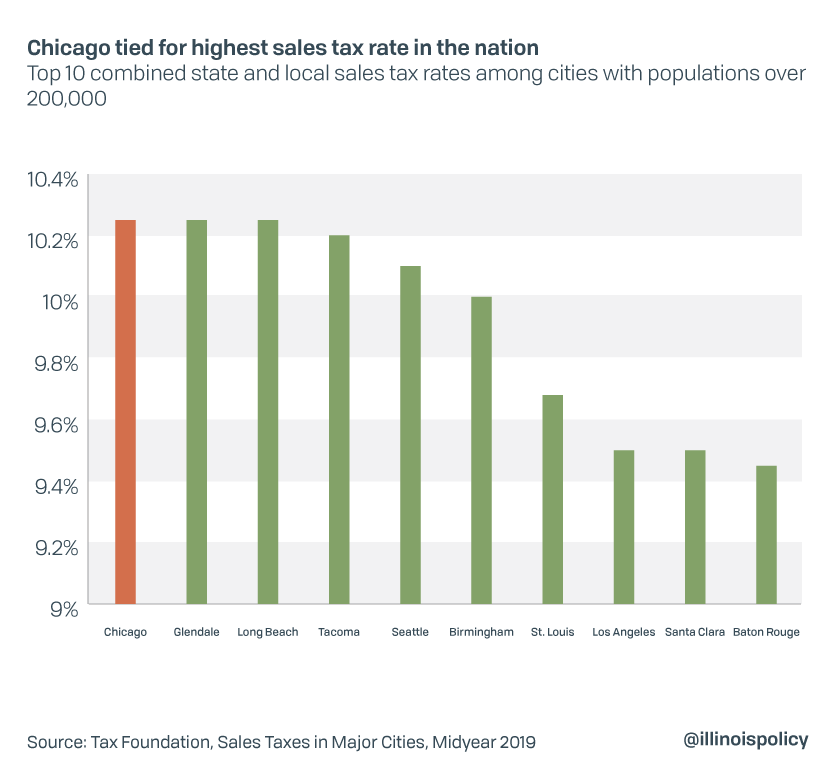

Cities With Highest Sales Tax Sales Tax Rates By City Tax Foundation

Pierce County Passes Tax Increase To Fund Mental Health Aid Tacoma News Tribune

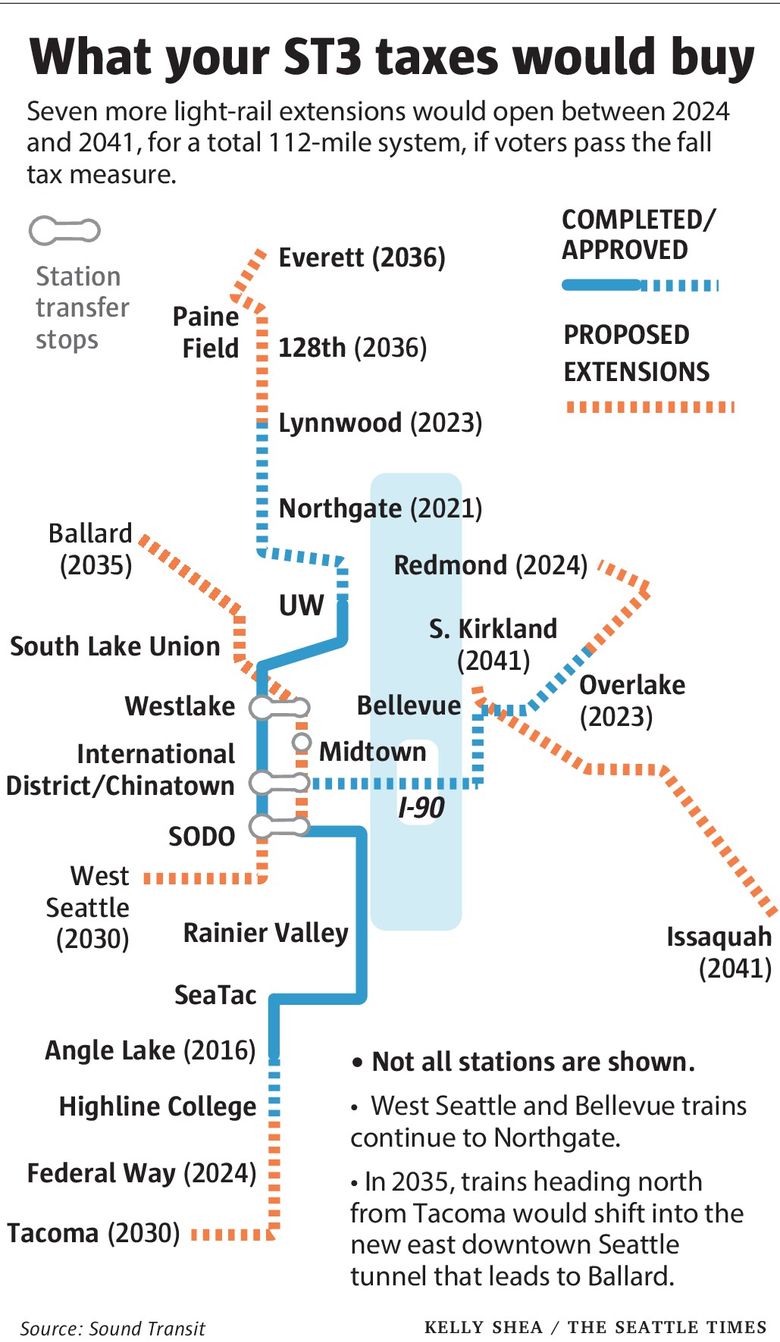

Sound Transit 3 Taxes How Much You D Pay And For How Long The Seattle Times

Voters To Decide On Taxes For Fixing Tacoma S Streets Tacoma News Tribune

Bill Would Prevent Rising Tacoma Narrows Tolls Extend Collections

Budget Funding Metro Parks Tacoma

Tacoma Is Number One Tacoma Daily Index

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Toyota Tacoma Lease Deals San Diego Ca Kearny Mesa Toyota

Chicago Defends Title Of Highest Sales Tax Rate In The Nation

Economic Impact And Tax Levy Port Of Seattle

5x7 7x6 Led Headlight With H4 Harness For Toyota Tacoma 95 97 82 95 Pickup Ebay

2016 Sept 28 Agenda Regular Meeting Tacoma Public Utilities

State And Local Sales Tax Rates 2018 Tax Foundation

Effects Of Changing Tax Policy On Commercial Real Estate

Who Really Pays Economic Opportunity Institute Economic Opportunity Institute