net investment income tax 2021 proposal

The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income. First the proposal would ensure that all trade or business income of high-income taxpayers is subject to the 38-percent Medicare tax either through the NIIT or SECA tax.

Free Editable Startup Funding Proposal Template Word Template Net Startup Funding Proposal Templates Up Proposal

A special transition rule provides that the proposed maximum tax rate of 25 percent would only apply to qualified dividends and long-term capital gains realized after September 13 2021.

. NOT just the extra 100000 but the full 400000 is subjected now to the 38 Net Investment Income Tax. Fortunately there are some steps you may be able to take to reduce its impact. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000.

High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. Trusts that are separately taxed will face a bigger issue under the proposed rules because the 5 tax would apply to all trust income exceeding 200000 making distributions of Distributable Net. All About the Net Investment Income Tax.

The proposal eliminates a perceived loophole by subjecting all trade or business income of individuals with earnings over 400000 individual or 500000 married couples to the 38. September 2021 Federal Tax Proposals. Plan ahead for the 38 Net Investment Income Tax.

Transfers of Appreciated Property. The NIIT applies to you only if modified adjusted gross income MAGI exceeds. If an individual has too little withholding or fails to pay enough quarterly estimated taxes to also cover the Net Investment Income Tax the individual may be subject to an.

This increase would be effective as of the date of the proposal ie September 13 2021. Highincome taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. A the undistributed net investment income or.

More specifically this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income MAGI surpasses the filing status-based thresholds the IRS. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. Form 8960 Instructions PDF provides details on how to figure the amount of investment income subject to the tax.

Single individuals with modified adjusted gross incomes in excess of 200000 and married individuals filing jointly with modified adjusted. 250000 for married taxpayers filing jointly and surviving spouses. The NIIT applies to you only if modified adjusted gross income MAGI exceeds.

Expansion of the 38 Net Investment Income Tax NIIT. Limit the qualified business income deduction under Section 199A QBI deduction to 500000 for joint returns 400000 for single taxpayers 250000 for married filing single and 10000 for trusts and estates. For taxpayers with AGI over 400000 the definition of net investment income NII would be amended to include gross income and gain from any trades or businesses that are not otherwise subject to.

Net Investment Income Tax Expansion. Fortunately there are some steps you may be able to take to reduce its impact. This expands the net investment income tax to cover net investment income derived in the ordinary course of a trade or business for high-income taxpayers.

The bill would subject individuals with taxable income in excess of 400000 500000 in the case of a joint return to the 38 NIIT on all net income or net gain from a trade or business regardless of whether the person participates in the trade or business that generated the income unless the income is subject to employment taxes FICA or self-employment taxes SECA. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts. Youll owe the 38 tax.

The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. The BBBA largely adopts without change the WM Proposals expansion of the 38 net investment income tax starting in 2022. For individuals that file jointly its the same process but the magic number is 500000 vs.

Fortunately there are some steps you may be able to take to reduce its impact. Your additional tax would be 1140 038 x 30000. This will apply to tax years beginning after Dec.

This proposal would be effective for tax years ending after Dec. B the excess if any of. NET INVESTMENT INCOME The Build Back Better Act proposes the new net investment income NII to be 38 tax for trade or business income for taxpayers earning more than 400000 annually.

If the proposal for raising the ordinary income tax rate to 396 becomes law then the maximum tax rate on capital gains would effectively be 434 396 plus net investment income tax rate of 38. This expands the net investment income tax to cover net investment income derived in the ordinary course of a trade or business for high-income taxpayers. In the case of an estate or trust the NIIT is 38 percent on the lesser of.

Trusts are hit hard The 38 surtax kicks in at much lower income levels for trusts. Surcharge on High Income Individuals Trusts and Estates. For 2021 the government will raise 275 billion in revenue generated from net investment income tax alone according an analysis by the Congressional Research Service.

The NIIT applies to you only if modified adjusted gross income MAGI exceeds. If an individual owes the net investment income tax the individual must file Form 8960 PDF. This tax only applies to high-income taxpayers such as single filers who make more than 200000 and married couples who make more than 250000 as well as certain estates and trusts.

Net investment income tax. The current rate is 37. Additionally the holding period for carried interests to qualify for long-term capital gains treatment would be extended from three years to five years.

250000 for married taxpayers filing jointly and surviving spouses. For estates and trusts the 2021 threshold is 13050. But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage.

We went from none of it being included at 300000 to all of it being included at 400000. This means an 8 surtax would apply to the highest earners by paying a top 45 federal marginal income tax rate on wages and business income. Long-term capital gains and qualified dividends of taxpayers with an adjusted gross income of more than 1 million would be taxed at ordinary income tax rates with 37 generally being the highest rate 408 including the net investment income tax but only to the extent that the taxpayers income exceeds 1 million 500000 for married.

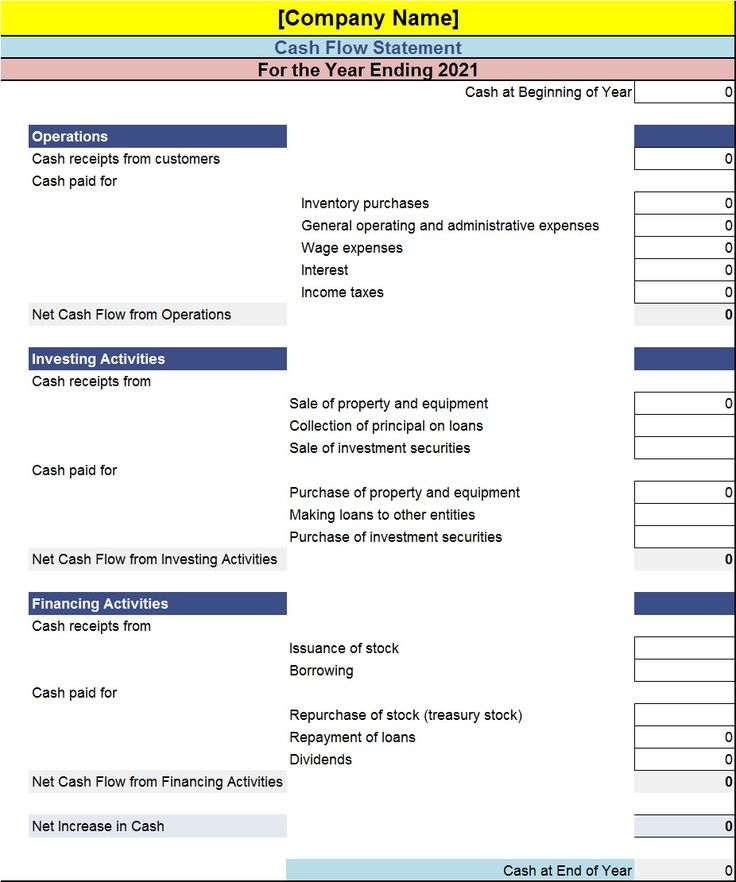

Cash Flow Statement Template Free Report Templates Cash Flow Statement Statement Template Cash Flow

Income Statement Templates 29 Free Docs Xlsx Pdf Formats Samples Examples Income Statement Statement Template Income

Generic Rental Application Https 75maingroup Com Rent Agreement Format Rental Application Real Estate Forms Rental Agreement Templates

Monthly Balance Sheet Excel Template Balance Sheet Balance Sheet Template Templates Free Design

Awesome Private Placement Agreement Template In 2021 Agreement Placement Templates

My Budget Worksheet Template Free Budget Spreadsheet Template How To Find Best Budget S Budgeting Worksheets Budget Spreadsheet Template Budget Spreadsheet

Business Valuation Calculator For A Startup Plan Projections Business Valuation Business Proposal Examples Financial Budget

To Book A Free Consultation With Our Web Design And Digital Marketing Specialists Go To Calendly Com Dkwd In 2021 Web Design Web Design Services Web Design Company

12 Weeks To Freedom By Gordon Jay Alexander In 2021 Jay Alexander How To Find Out Make A Proposal

Capital Budgeting Introduction Techniques Process In 2021 Budgeting Budgeting Process Financial Health

Tax Facts On Individuals 127th Edition Ebook In 2021 Business Ebook Health Insurance Humor Small Business Accounting

Profit Sharing Calculator For A Startup Business Plan Projections Profit Shares Startup Business Plan How To Plan

Commercial Photography Business Plan Template Google Docs Word Apple Pages Pdf Template Net In 2021 Photography Business Plan Photography Business Business Plan Template

Functions Of Hr Payroll Payroll Software Tax Saving Investment

Ulip Is Taxable Tax Free Investments Start Up Business Income Tax

Mini Business Plan Template Best Of Growth Strategies For Your Business Free Business Proposal Template Business Proposal Template Business Plan Template Word

Document Management Proposal Template Request For Proposal Proposal Templates Business Proposal Template